The Gamestop Short Squeeze: The Ragtag Group of Amateur Traders That Brought Wall Street to Its Knees

In late January 2021, the stock market witnessed an unprecedented event that shook the foundations of Wall Street and sent shockwaves through the global financial system. A group of amateur traders, operating largely on the online forum Reddit, banded together to execute a short squeeze on the shares of GameStop, a struggling video game retailer. The result was a historic surge in GameStop's stock price, causing billions of dollars in losses for hedge funds that had bet against the company.

The Gamestop short squeeze was a David vs. Goliath story that pitted a group of ordinary investors against some of the most powerful financial institutions in the world. It was a triumph for the little guy, and it sent a clear message to Wall Street: the days of unchecked greed and manipulation were over.

This article will delve into the details of the Gamestop short squeeze, from its humble beginnings on Reddit to its explosive climax. We will also explore the impact of this event on the stock market and the broader financial landscape.

4.2 out of 5

| Language | : | English |

| File size | : | 954 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 305 pages |

| Screen Reader | : | Supported |

The story of the Gamestop short squeeze begins on the subreddit WallStreetBets, a forum where users discuss stock market investing. In early 2021, a group of users on WallStreetBets began to notice that GameStop's stock was heavily shorted by hedge funds. Shorting a stock is a betting strategy in which investors borrow shares of a company and sell them, hoping to buy them back later at a lower price. If the stock price goes down, the short seller profits.

The users on WallStreetBets realized that GameStop's stock was being shorted to an unsustainable level. They believed that if they could buy enough shares of GameStop, they could force the short sellers to cover their positions, which would drive the stock price up even further.

The users on WallStreetBets began to coordinate their efforts to buy GameStop shares. They used social media to spread the word about their plan, and they encouraged other retail investors to join them. Soon, a large group of amateur traders, known as the Reddit army, was buying GameStop shares in droves.

As the Reddit army bought more shares, the price of GameStop began to rise. The short sellers were forced to cover their positions, which drove the stock price even higher. By the end of January, GameStop's stock price had soared from around $20 to over $400.

The Gamestop short squeeze caused billions of dollars in losses for hedge funds. Some hedge funds were forced to close down, and others were forced to sell off other assets to cover their losses. The hedge funds' losses were a major blow to the financial industry, and they sent a clear message that the old ways of ng business were no longer acceptable.

The Gamestop short squeeze had a significant impact on the stock market and the broader financial landscape. First, it showed that the power of social media could be used to move markets. The Reddit army was able to coordinate their efforts to buy GameStop shares and drive the price up, even though they were up against some of the most powerful financial institutions in the world.

Second, the Gamestop short squeeze exposed the risks of excessive short selling. The hedge funds that shorted GameStop's stock were betting against the company, and they were not prepared for the possibility that the stock price could go up. The Gamestop short squeeze showed that short selling can be a risky strategy, and it led to new regulations being put in place to prevent excessive short selling.

Third, the Gamestop short squeeze helped to level the playing field between retail investors and institutional investors. For years, retail investors have been at a disadvantage compared to institutional investors, who have access to more information and resources. The Gamestop short squeeze showed that retail investors can band together to move markets, and it gave them a new sense of confidence.

The Gamestop short squeeze was a watershed moment in financial history. It showed that the power of social media could be used to move markets, it exposed the risks of excessive short selling, and it helped to level the playing field between retail investors and institutional investors. The Gamestop short squeeze will be remembered as a time when the little guy took on Wall Street and won.

Here are some of the long-term impacts of the Gamestop short squeeze:

- Increased regulation of short selling: The Securities and Exchange Commission (SEC) has implemented new regulations to prevent excessive short selling. These regulations include limits on the amount of stock that can be shorted and requirements for short sellers to disclose their positions.

- Greater awareness of retail investors: The Gamestop short squeeze has raised awareness of the power of retail investors. Retail investors can now use social media to coordinate their efforts and move markets.

- A shift in the balance of power between retail investors and institutional investors: The Gamestop short squeeze has helped to level the playing field between retail investors and institutional investors. Retail investors now have a greater voice in the market, and they are more likely to be taken seriously by institutional investors.

- A new era of financial populism: The Gamestop short squeeze has inspired a new era of financial populism. Retail investors are now more likely to challenge the status quo and to demand a fairer financial system.

The Gamestop short squeeze was a major event that has had a significant impact on the stock market and the broader financial landscape. It is a story that will be told for years to come, and it is a reminder that anything is possible in the world of finance.

4.2 out of 5

| Language | : | English |

| File size | : | 954 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 305 pages |

| Screen Reader | : | Supported |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Top Book

Top Book Novel

Novel Fiction

Fiction Nonfiction

Nonfiction Literature

Literature Paperback

Paperback Hardcover

Hardcover E-book

E-book Audiobook

Audiobook Bestseller

Bestseller Classic

Classic Mystery

Mystery Thriller

Thriller Romance

Romance Fantasy

Fantasy Science Fiction

Science Fiction Biography

Biography Memoir

Memoir Autobiography

Autobiography Poetry

Poetry Drama

Drama Historical Fiction

Historical Fiction Self-help

Self-help Young Adult

Young Adult Childrens Books

Childrens Books Graphic Novel

Graphic Novel Anthology

Anthology Series

Series Encyclopedia

Encyclopedia Reference

Reference Guidebook

Guidebook Textbook

Textbook Workbook

Workbook Journal

Journal Diary

Diary Manuscript

Manuscript Folio

Folio Pulp Fiction

Pulp Fiction Short Stories

Short Stories Fairy Tales

Fairy Tales Fables

Fables Mythology

Mythology Philosophy

Philosophy Religion

Religion Spirituality

Spirituality Essays

Essays Critique

Critique Commentary

Commentary Glossary

Glossary Bibliography

Bibliography Index

Index Table of Contents

Table of Contents Preface

Preface Introduction

Introduction Foreword

Foreword Afterword

Afterword Appendices

Appendices Annotations

Annotations Footnotes

Footnotes Epilogue

Epilogue Prologue

Prologue Mike Doyle

Mike Doyle A C Grayling

A C Grayling Mark Ludwig

Mark Ludwig Christopher Lubienski

Christopher Lubienski Robert Enright

Robert Enright Matthew Gunn

Matthew Gunn Mark Purnell

Mark Purnell Sam Tatam

Sam Tatam Leonard O Pellicer

Leonard O Pellicer Diane Winger

Diane Winger Mark Twain

Mark Twain Caroline Peckham

Caroline Peckham Becky Thomas

Becky Thomas Orna Ross

Orna Ross David Blixt

David Blixt Deborah Schoeberlein David

Deborah Schoeberlein David Marshall I Goldman

Marshall I Goldman Paul Anderson

Paul Anderson James Turk

James Turk Christopher J Coyne

Christopher J Coyne

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Ethan GrayFollow ·12.6k

Ethan GrayFollow ·12.6k Austin FordFollow ·9.2k

Austin FordFollow ·9.2k Haruki MurakamiFollow ·5.1k

Haruki MurakamiFollow ·5.1k Bryson HayesFollow ·16.4k

Bryson HayesFollow ·16.4k Ivan TurnerFollow ·6.7k

Ivan TurnerFollow ·6.7k Aron CoxFollow ·12.7k

Aron CoxFollow ·12.7k Dave SimmonsFollow ·13.6k

Dave SimmonsFollow ·13.6k Chase SimmonsFollow ·14.3k

Chase SimmonsFollow ·14.3k

Chase Simmons

Chase SimmonsCompletely Unputdownable Serial Killer Thriller:...

Prepare yourself for an...

Bruce Snyder

Bruce SnyderThe Likeness: A Spine-Chilling Crime Novel by Tana French

Step into the Shadows of a Twisted...

Langston Hughes

Langston HughesDiscover the Enchanting World of Cute Animals: A Journey...

Welcome to the...

Adrian Ward

Adrian WardDelving into the Profoundly Disturbing World of No Longer...

In the realm of horror manga, Junji Ito...

Edgar Allan Poe

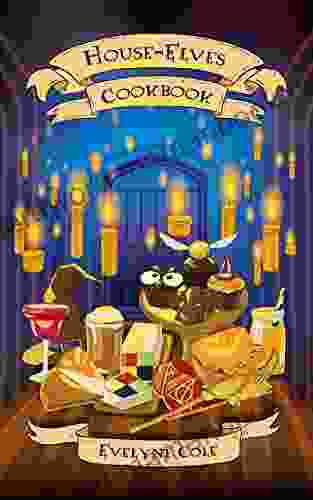

Edgar Allan PoeIllustrated Magical Recipes For Wizards And Witches:...

In the realm of witchcraft and wizardry,...

Joe Simmons

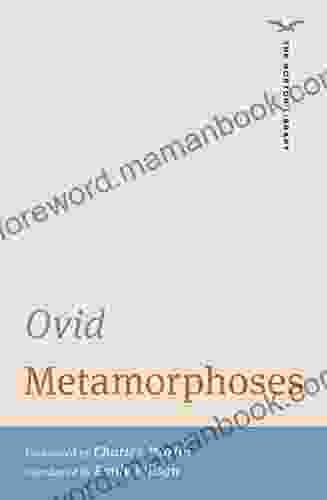

Joe SimmonsMetamorphoses: A Masterpiece of Ancient Greek Mythology...

Metamorphoses, a seminal work of...

4.2 out of 5

| Language | : | English |

| File size | : | 954 KB |

| Text-to-Speech | : | Enabled |

| Enhanced typesetting | : | Enabled |

| X-Ray | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 305 pages |

| Screen Reader | : | Supported |